Do you want your own IDBI Virtual Debit Card? Then you are in the right place. Here you will get all the steps and guides for applying for the IDBI Virtual Debit Card Online. In the era of seamless digital transactions, IDBI Bank has leaped forward by introducing the Virtual Debit Card feature on its mobile banking platform.

This innovative offering allows IDBI customers to acquire a free virtual debit card swiftly, providing a secure and convenient way to make online payments. In this easy and simple guide, we will walk you through the steps to create your IDBI Virtual Debit Card, explore its benefits, address common queries, and highlight the security measures associated with this digital marvel.

Introduction: Embracing the IDBI Virtual Debit Card

If you are an IDBI customer, the prospect of obtaining a virtual debit card is at your fingertips. The IDBI Virtual Debit Card, accessible through the mobile banking application, complements your physical debit card, offering an alternative for online transactions. In this guide, we will not only delve into the step-by-step process of acquiring your virtual debit card but also unravel the myriad advantages it brings to the digital forefront.

What are the Steps to Create an IDBI Virtual Debit Card?

The journey to securing your IDBI Virtual Debit Card is straightforward. Here’s a step-by-step guide to walk you through the process:

Step 1: Access IDBI Mobile Banking

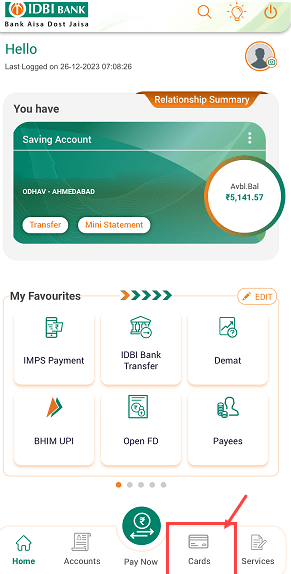

- Open your IDBI Mobile Banking application.

- Navigate to the “Cards” dashboard, which displays options for Debit cards, credit cards, and Virtual Cards.

Step 2: Select Debit Card Option

- In the “Debit Card” section, manage both physical and virtual debit cards.

- Choose the “Virtual Card” option to create and manage your virtual debit card.

Step 3: Create a Virtual Debit Card

- Tap on “Create Virtual Card” to initiate the process.

- Select your IDBI account number, card type (VISA, RUPAY, or MasterCard), card variant (classic), set card validity, and proceed to the next step.

Step 4: Confirmation and OTP

- Confirm your selections and choose “Receive OTP via SMS.”

- Enter the 6-digit OTP received on your registered mobile number.

Step 5: Card Activation and Viewing

- Wait for 2 working days for card activation.

- Once activated, view your Virtual Debit Card details, including the card number, expiry date, and CVV, by tapping on “View Virtual Card.”

How to View Your IDBI Virtual Debit Card from Mobile Banking

After creating your Virtual Debit Card, accessing its details is a breeze through IDBI Mobile Banking:

- Go to the “Cards” section.

- Under “Debit Card,” find the “Virtual Card” option.

- Select “View Virtual Card” to manage and view your card details, including the card number, CVV, and expiry date.

See This:- How to Check Canara Bank Debit Card Details Online?

How to Manage your IDBI Bank Account Virtual Debit Card

Effortlessly manage your IDBI Virtual Debit Card through mobile banking:

- Tap on the “Manage Debit Card” section.

- Set limits and manage usage for your virtual card.

The Top Benefits of Having an IDBI Virtual Debit Card

Embracing the IDBI Virtual Debit Card comes with a multitude of benefits, including:

- Convenient Online Payments: Make secure online payments on e-commerce websites, merchant platforms, and payment gateways without the need for a physical debit card.

- Enhanced Security: Shield your physical debit card details by using the virtual card for online transactions, adding an extra layer of security.

- Customizable Features: Tailor your virtual card’s validity, usage, and limits to suit your preferences and requirements.

- Free of Charge: The IDBI Virtual Debit Card is provided free of charge, offering a cost-effective solution for digital transactions.

7 Security Measures to Consider When Generating an IDBI Virtual Debit Card

While the IDBI Virtual Debit Card enhances convenience, it’s crucial to prioritize security. Consider these measures:

- Log Out After Usage: Always log out of your mobile banking after managing or viewing your virtual card to prevent unauthorized access.

- Confidentiality: Refrain from sharing your virtual card details, including the CVV, to ensure the security of your transactions.

- Hide Details: Deactivate the “Card Details” and “CVV” buttons to hide information, enhancing security after verification.

- Secure Networks: Avoid generating virtual cards or conducting transactions on public Wi-Fi networks; opt for secure and private networks.

- Regular Monitoring: Scrutinize your account statements regularly for any unauthorized transactions and report discrepancies promptly to the bank.

- Complex Authentication: Choose complex passwords and MPINs during the authentication process to enhance security.

- Timely Authentication: Take your time during authentication to ensure accuracy, avoiding unnecessary delays by inputting correct details.

The Pros and Cons of Using an IDBI Virtual Debit Card

While the IDBI Virtual Debit Card offers numerous advantages, it’s essential to consider both sides of the coin:

Pros:

- Enhanced Security: Protect your physical debit card details by using the virtual card for online transactions.

- Customization: Tailor the virtual card’s validity, usage, and limits according to your preferences.

- Cost-Effective: The IDBI Virtual Debit Card is provided free of charge, offering a budget-friendly solution.

Cons:

- Dependency on Technology: Virtual cards rely on technology, and issues such as network outages or technical glitches may impact their usability.

- Limited Usage: While ideal for online transactions, virtual cards may not be suitable for certain in-person or offline scenarios.

Why Should I Choose IDBI Bank for a Virtual Debit Card?

IDBI Bank stands out as a preferred choice for obtaining a virtual debit card due to the following reasons:

- Innovative Solutions: IDBI Bank consistently introduces innovative features, such as the Virtual Debit Card, to provide customers with advanced banking solutions.

- User-Friendly Mobile Banking: The IDBI Mobile Banking application offers a seamless interface, making it easy for customers to manage and view their virtual debit cards.

- Cost-Effective Services: The IDBI Virtual Debit Card is provided free of charge, aligning with the bank’s commitment to offering cost-effective and accessible banking solutions.

Is it Easy to Generate an IDBI Virtual Debit Card?

Yes, the process of generating an IDBI Virtual Debit Card is designed to be user-friendly and accessible. By following the step-by-step instructions on the IDBI Mobile Banking application, customers can create their virtual debit cards with ease.

Also Check:- How to Set HDFC User ID Online?

What Information Do I Need to Create an IDBI Virtual Debit Card?

To create an IDBI Virtual Debit Card, you will need the following information:

- IDBI Mobile Banking Access: Ensure you have access to the IDBI Mobile Banking application on your device.

- OTP: You will receive a 6-digit OTP on your registered mobile number for verification during the virtual card creation process.

- Account Details: Select your IDBI account number and choose your card type, variant, and validity.

Are There Any Fees Associated with IDBI Virtual Debit Card Creation?

No, there are no fees associated with creating an IDBI Virtual Debit Card. The bank offers this service free of charge to its customers, aligning with its commitment to providing cost-effective banking solutions.

Final Words: Elevate Your Digital Banking Experience with IDBI Virtual Debit Card

As we navigate the digital landscape, the IDBI Virtual Debit Card emerges as a beacon of convenience and security. By seamlessly integrating into the IDBI Mobile Banking platform, this virtual card empowers customers to make online transactions with ease. The ability to customize usage, set limits, and enjoy cost-effective services makes the IDBI Virtual Debit Card a valuable addition to the banking experience.

Embark on the journey of obtaining your IDBI Virtual Debit Card through the user-friendly mobile banking application. Safeguard your physical debit card details, embrace the digital era, and experience the freedom of secure online transactions with IDBI Bank. Elevate your banking experience – the future is virtual, and it’s here with IDBI.

Common FAQs About IDBI Virtual Debit Card Creation

Addressing common queries about the IDBI Virtual Debit Card creation process:

Are there any charges for the IDBI Virtual Debit Card?

No, the IDBI Virtual Debit Card is free, and you can obtain it through mobile banking.

Where can I use the IDBI Bank Virtual Card?

The IDBI Virtual Debit Card can be used for online payments on e-commerce websites and other platforms that accept debit cards.

What is the validity period of this card?

You can set the validity period for the card, with a maximum limit of up to 5 years.

How do I use the IDBI Virtual Debit Card?

Use the virtual card for online payments by logging into your mobile banking, checking the details, and entering them on the payment page.