The textile industry is one of the few CFD trading platform manufacturing sectors where China does not have a dominant market share. In fact, according to a report by the United Nations. Conference on Trade and Development (UNCTAD), the global textile and apparel industry, is currently worth US$ 1 trillion, with China accounting for only around 30% of that value. Therefore, it provides a significant opportunity for other countries to increase their global textile market share.

Moreover, Bangladesh possesses several notable advantages in the realm of textile production. These advantages encompass abundant access to raw materials, a well-established infrastructure, and comparatively low labour costs. Notably, Bangladesh stands as the world’s second-largest clothing exporter, second only to China, as reported by UNCTAD.

Bangladesh also confronts certain hurdles. Infrastructure poses a significant challenge, encompassing issues such as insufficient electricity supply and inadequate transportation networks. Moreover, the country’s political and social stability is prone to threats from religious extremism and terrorist activities.

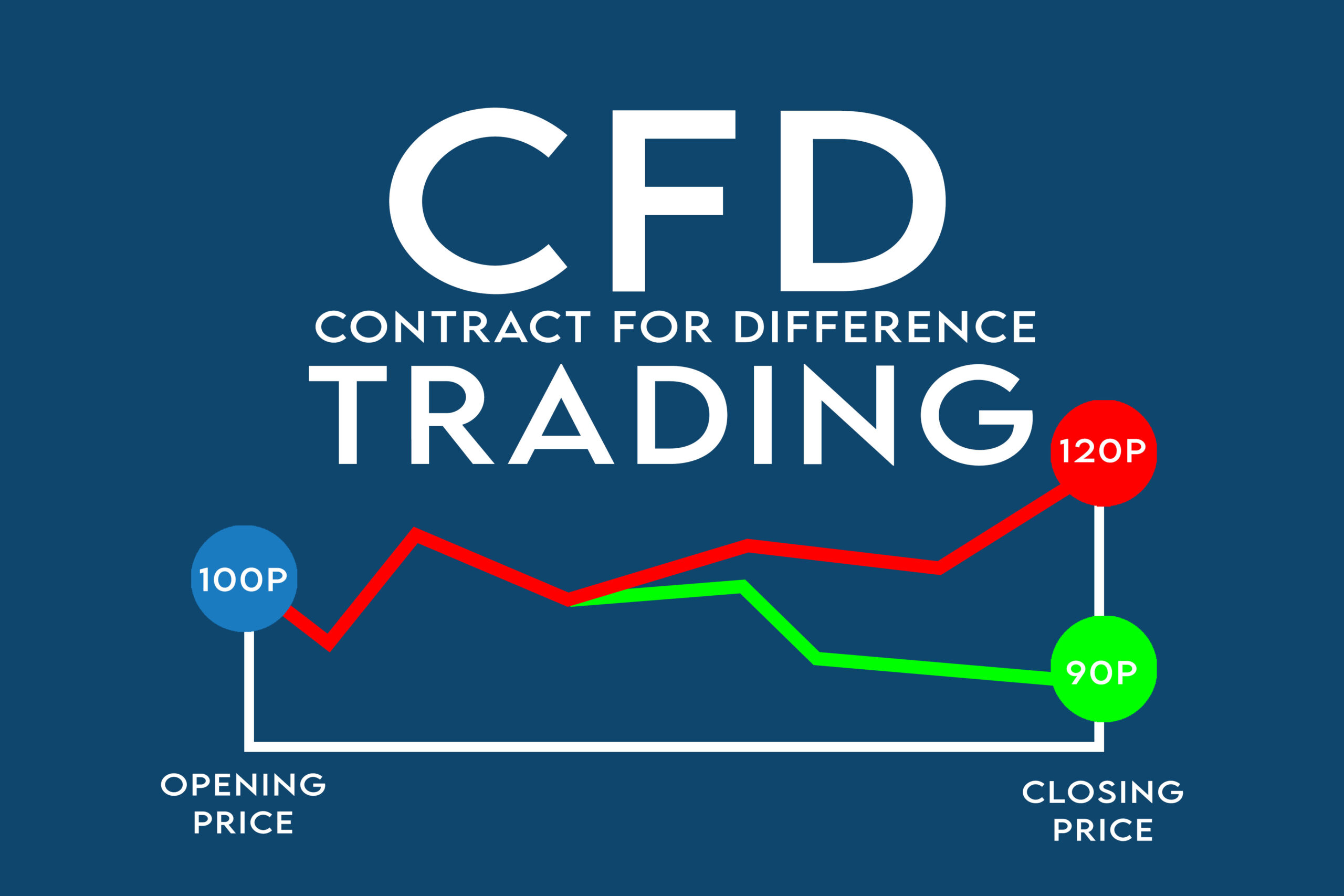

Nevertheless, Bangladesh has managed to maintain a substantial textile industry. Additionally, the nation has established free trade agreements with key markets like the European Union and the United States. Furthermore, CFD trading offers the added advantage of facilitating the short-selling of textile products with relative ease.

The textile industry is under pressure from several different sources. CFD trading is a flexible and convenient way to trade textile products, and it offers several advantages over traditional methods. Finally, CFD trading is much more flexible than traditional methods of trading textile products. For example, you can trade at any time and choose the amount of money you want to put into a position.

How Does CFD Trading Help the Textile Industry?

CFD trading can help the textile industry in terms of production and exports by providing a way to hedge against fluctuations in prices and by allowing companies to speculate on future market conditions.

How is CFD Trading Ruining the Textile Industry?

Hedge funds and other financial institutions often employ this tactic as a means to swiftly generate profits. As an illustration, if a consortium of traders anticipates a decline in the value of a specific textile stock, they can engage in short selling using CFD contracts. This action exerts downward pressure on the price, enabling the traders to capitalize on the situation and realize gains.

Nonetheless, when the price of the textile stock experiences a decline, it reverberates within the real economy. Consequently, textile companies are compelled to implement cost-cutting measures in order to retain competitiveness, often resulting in workforce reductions and the closure of factories.

The textile industry is in a very precarious position, and it is time for something to be done about CFD trading. Otherwise, the industry could be destroyed, and millions of people could lose their jobs.

Why the Textile Industry Requires CFDs?

The textile industry is one of the world’s most significant manufacturing sectors. To meet the demands of consumers, textile companies need to produce large quantities of textiles efficiently and quickly. It can be achieved through CFD trading.

For companies in the textile industry, utilizing CFD trading is essential to mitigate risk and take advantage of market price fluctuations. By using CFD contracts, these companies can protect themselves against unexpected changes in the value of underlying assets, such as sudden drops in cotton prices. This allows them to proactively manage their exposure and navigate market volatility with confidence.

Additionally, CFD trading allows companies to take advantage of price movements in the market without incurring the high costs associated with owning the underlying asset.

How can Textile Firms Use CFD Trading to Protect Against Unanticipated Price Fluctuations?

By utilizing CFD Trading, textile companies can safeguard themselves against unforeseen price fluctuations by mitigating their exposure to the underlying commodity. In a market characterized by volatility, prices can rapidly and unexpectedly fluctuate, thereby exerting pressure on margins and inflicting financial losses. By hedging their exposure using CFDs, textile companies can minimize the likelihood of failure and safeguard their profits.

The seller of the CFD contract agrees to pay the buyer the difference between the asset’s current price and the price at which the contract was entered into if the asset price moves in the buyer’s favour. However, if the asset price moves against the buyer, the seller pays nothing.

Conclusion

In addition, CFD trading offers notable advantages in terms of efficiency compared to traditional trading methods like futures and options. As an increasing number of textile companies embrace CFD trading, it is anticipated that we will witness a substantial transformation in industrial operations.

Also check: Is Bitcoin Still a Safe Investment?