What is The Doji Candle Pattern?

The doji candle pattern is a technical analysis indicator that is used to predict future movements in the stock market’s Official Platform. The doji candle is a candle with two red or black candles. These candles usually appear at the opening and closing of the trading day.

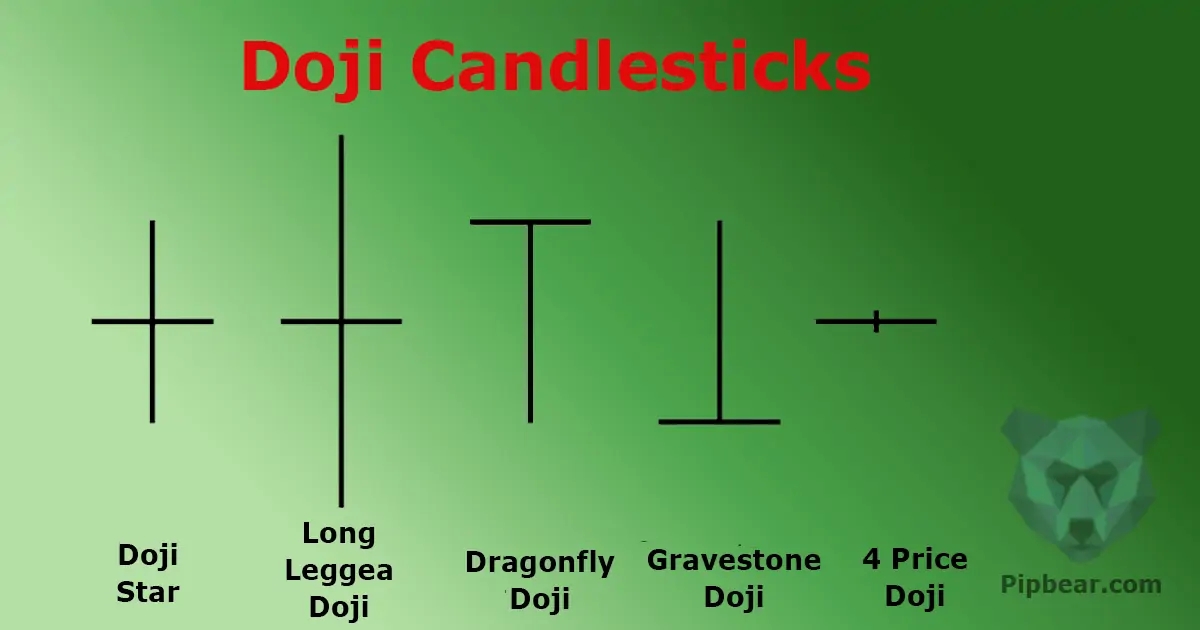

The doji candle pattern is used to identify indecision in the market, and to predict future movements. The doji candle is a reversal indicator, which means that it signals a potential change in trend. The doji candle is most often used in the stock market, but it can also be used in the forex market and the commodities market.

How To Trade With The Doji Candle Pattern

The doji candle pattern is a technical indicator that is used to identify buying and selling opportunities. This pattern is also known as the “horse race” indicator because it often corresponds with major stock market movements. When you see the doji candle pattern, it means that there is a current round of selling, but it’s not clear yet which direction the selling will continue in.

This is because the candle is half-closed, which means that the buyers and sellers are not quite in agreement about the price of the stock. When you see the doji candle pattern, it’s important to stay calm and wait for the market to clear before you make any decisions. Sometimes the doji candle pattern can lead to big market movements, so you don’t want to jump in prematurely and lose money.

The Doji Candle Pattern is a Signal For Buying or Selling

The doji candle pattern is a technical indicator that can be used to buy or sell stocks or other financial instruments. The indicator consists of two candles, the first of which is called the dark candle and the second the light candle. The pattern is named after the Japanese candlestick maker who first identified it in 1881.

The doji candle is characterized by a symmetrical close with no significant movement between the open and the close prices. The doji candle pattern can be used to identify indecision in the market and to predict future movements. It is also a useful tool for Technical Analysts and traders.

Using The Doji Candle Pattern to Improve Your Trading Skills

The doji candle pattern is often used in technical analysis to identify potential market trends. In this article, we will discuss how to use the doji candle pattern to improve your trading skills. The doji candle pattern is a technical indicator that is used to identify patterns in financial markets.

The indicator is composed of two candles: the first candle is a tall candle with a long body and a short neck, and the second candle is a short candle with a short body and a long neck. The doji candle pattern is used to identify potential market trends. The doji candle pattern is composed of two candles:

The first candle is a tall candle with a long body and a short neck, and the second candle is a short candle with a short body and a long neck. The doji candle pattern is used to identify potential market trends. The doji candle pattern is composed of two candles: the first candle is a tall candle with a long body and a short neck, and.

The second candle is a short candle with a short body and a long neck. The doji candle pattern is used to identify potential market trends. The doji candle pattern is composed of two candles: the first candle is a tall candle with a long body and a short neck, and the second candle is a short candle with a short body and a long neck.

The Doji Candle Pattern As a Trading Tool

The doji candle pattern is a technical indicator used in technical analysis. It consists of two candles that look almost identical but have different closing prices. This pattern is named after the Japanese candlestick maker who first identified it in the 1800s. The doji candle is used as a trading tool when you want to know if the market is about to go up or down.

When you see the doji candle, you should always wait for the second candle to close before you make a decision. If the second candle is higher than the first, then it means the market is going up. If the second candle is lower than the first, then it means the market is going down.

Read now: Valuation Trends in Cryptocurrency Market